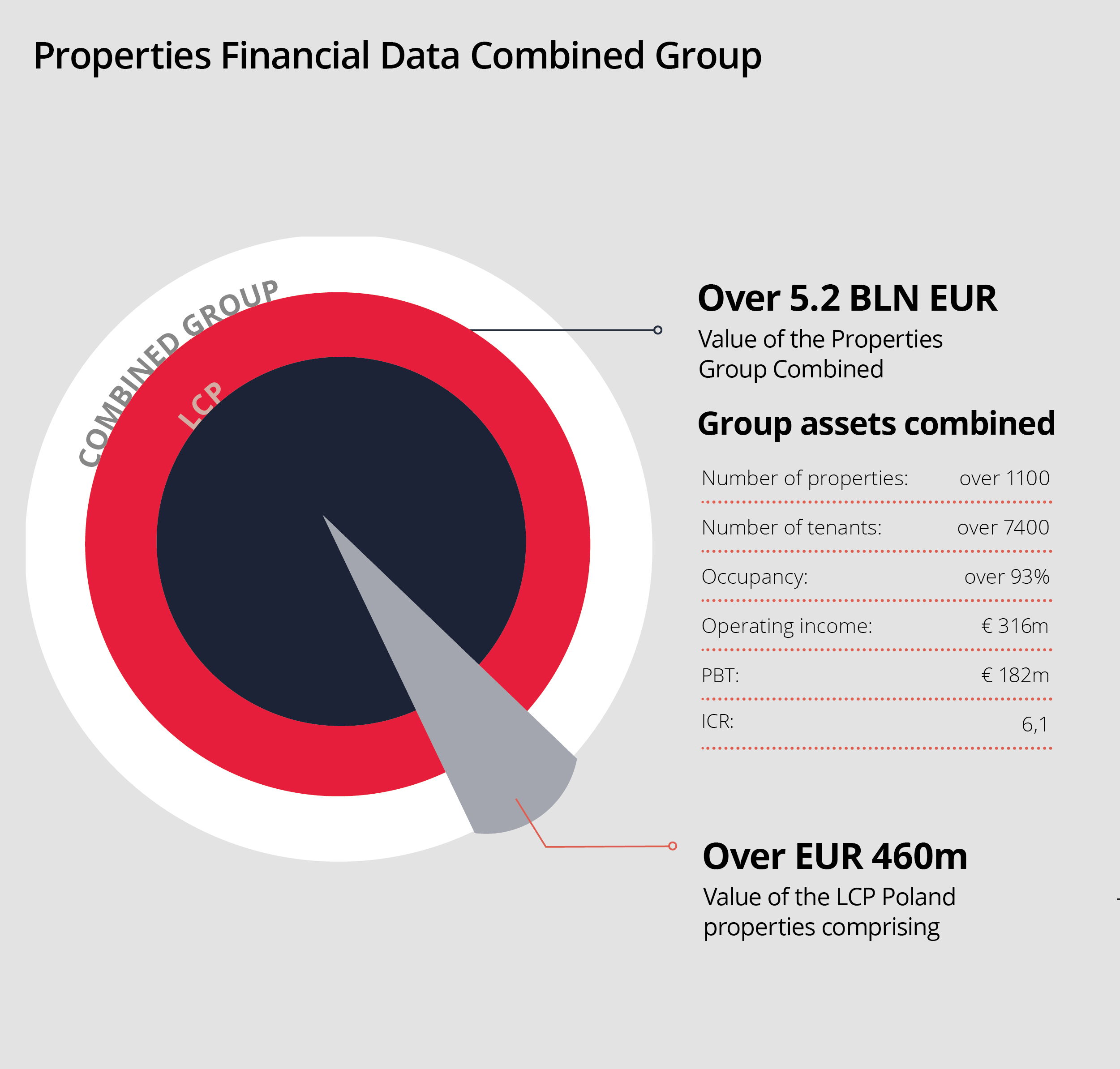

London & Cambridge Properties Ltd. is one of the largest property investment companies in Europe with over € 5.2 billion of assets under ownership and management in UK, France, Germany and Poland. LCP was founded in 1987 and started investing in Poland in 2005. Our portfolio in Poland includes +80 properties with a value of over EUR 400 million and an area of +300,000 sq m. located in various parts of the country.

We're managing properties in the UK, France, Germany and Poland.

We are standing out by our continuous expansion into countries and sectors where the potential to apply the basic philosophy allows us to generate significant returns over the long term.

LCP

Leading asset management of blended portfolios across UK, Poland and Germany,

Sheet Anchor

A strategic investment vehicle providing funding through multiple subsidiaries,

LCP

Leading asset management of blended portfolios across UK, Poland and Germany

Sheet Anchor

A strategic investment vehicle providing funding through multiple subsidiaries

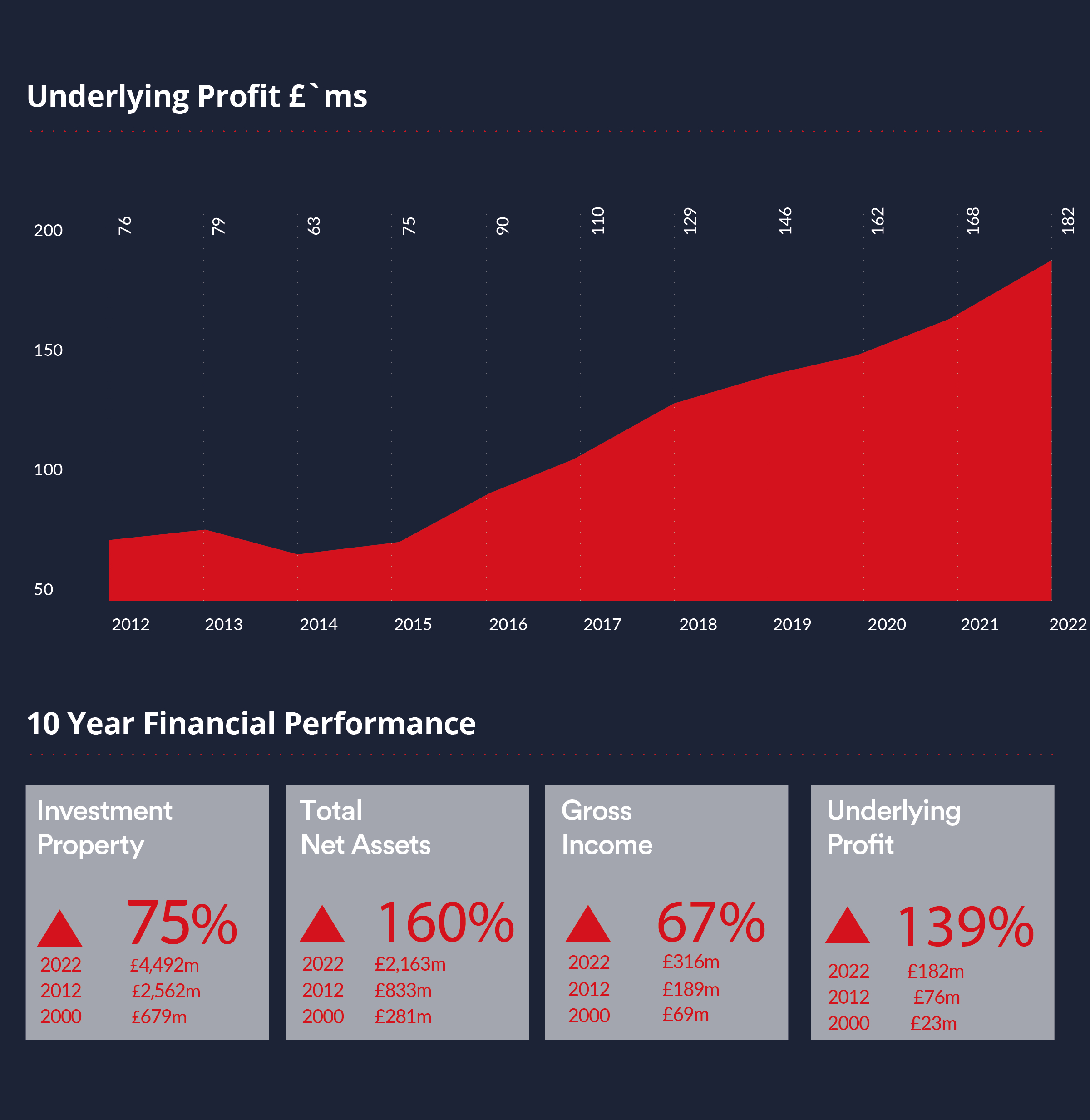

LCP Group is a British investment group operating in the commercial Real Estate sector. Since 2005, as LCP Properties, we have been successfully developing cooperation with partners and commercial networks in Poland.

Our portfolio includes +80 properties with a value of over EUR 460 million and an area of 300,000 sq m. located in various parts of the country.

LCP Group is a British investment group operating in the commercial Real Estate sector. Since 2005, as LCP Properties, we have been successfully developing cooperation with partners and commercial networks in Poland.

Our portfolio includes 70 properties with a value of over EUR 300 million and an area of 260,000 sq m. located in various parts of the country.

Continuous expansion in sectors where the potential for the application of our philosophy enables us to generate significant returns over the long term.

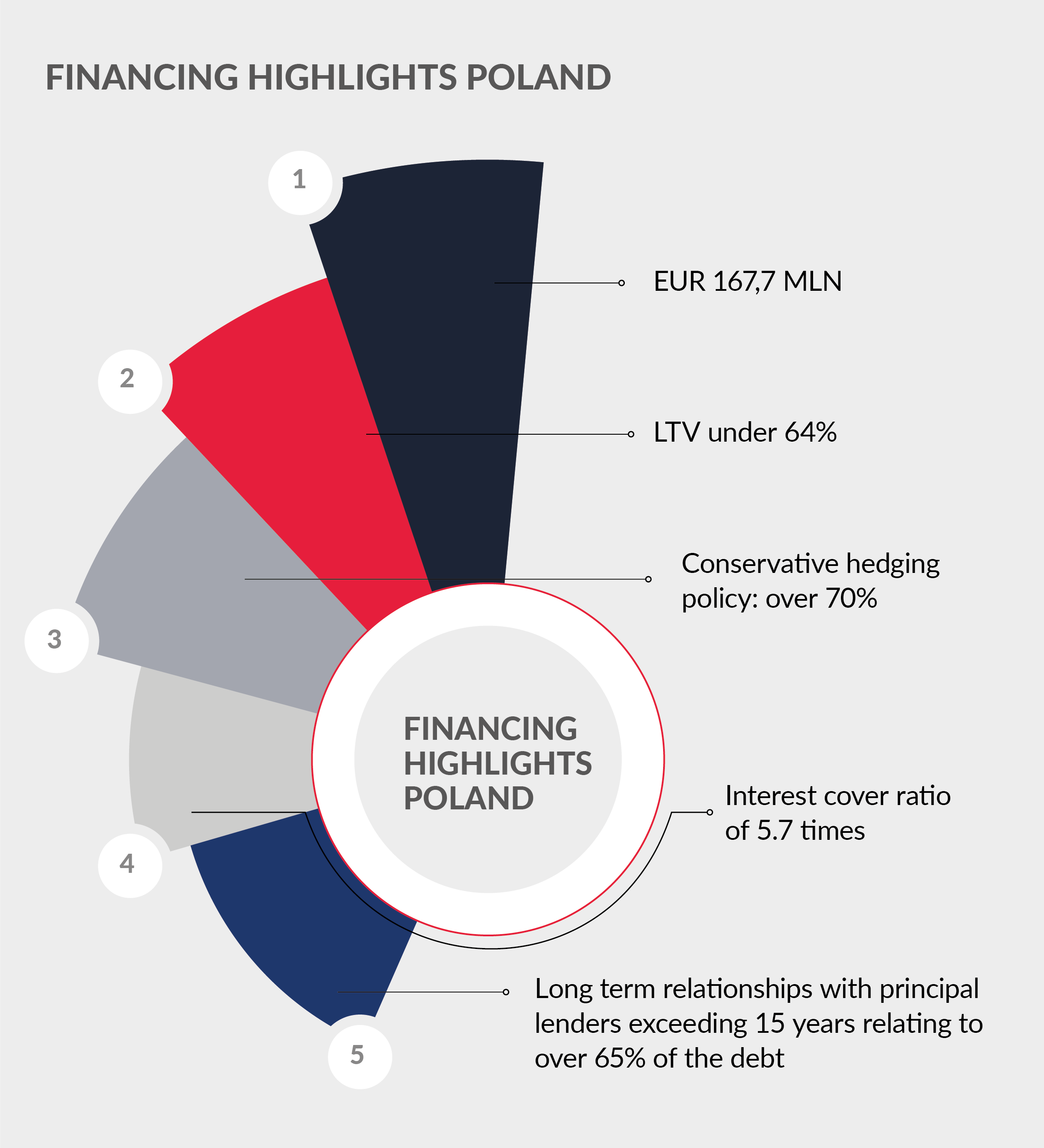

Granularity of tenant exposure with no single tenant representing more than 2.5%

The pandemic has led to unprecedented measures taken across the globe including enforced closure of most industries and restriction of peoples’ movements.

During the pandemic, the combined Group has increased emphasis on cash collections and management of tenants to maximise recoveries while protecting occupancy levels going forward

Cash collections in excess of 95% during the period occupancy levels have been maintained

LCP's strategy involves reinvesting profits and acquiring further properties. This creates a "snowball" effect, which quickly helps to increase the value of the portfolio. Thanks to such an approach we can present the current value of LCP Poland's portfolio, which the Company has managed to generate since the beginning of its activity in Poland.

LCP Properties is a leading investment capital group on the Polish market. We are a long-term investor which profits from proactive management of properties whose value is particularly important to us.

Main reception

Retail Parks space to lease

Space for lease in Multiparcs (SBU)